ICHRA vs. QSEHRA: Choosing the right HRA for your business

An ICHRA allows businesses to reimburse employees for health insurance, while a QSEHRA is designed for small businesses with fewer than 50 employees and has annual contribution limits. Read on to determine which option best fits your company's needs.

Health Reimbursement Arrangements (HRAs) offer businesses a flexible way to help employees cover medical expenses. As healthcare costs rise, more employers are turning to HRAs to balance affordability with quality benefits.

When comparing an ICHRA vs. a QSEHRA, the key difference is eligibility:

A Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is for small businesses with fewer than 50 employees.

An Individual Coverage Health Reimbursement Arrangement (ICHRA) is available to businesses of any size, offering greater flexibility.

With HRAs growing in popularity, choosing the right option depends on your company’s size, employee needs, and budget. A recent Thatch survey found that 36% of small businesses cite rising employee benefit costs as a top challenge, making HRAs an attractive solution.

Defining ICHRA and QSEHRA

Understanding the differences between an ICHRA and a QSEHRA is key to choosing the right health reimbursement arrangement for your business. Below is a breakdown of how they work and what makes them unique.

What is an ICHRA?

An ICHRA allows businesses of any size to reimburse employees tax-free for individual health insurance premiums and qualified medical expenses.

Introduced in 2020, an ICHRA offers:

Flexibility: Employers can set different reimbursement amounts for different employee classes (e.g., full-time, part-time, seasonal).

Choice: Employees select their own insurance plans, ensuring coverage that fits their needs.

Scalability: Employers can adjust reimbursement levels and employee classes over time, making ICHRA a flexible solution for growing businesses.

Individual marketplace compatibility: Employees can use ICHRA funds for plans purchased through the marketplace or directly from insurers.

Start exploring health insurance plans in your area.

What is a QSEHRA?

A QSEHRA is a health benefit designed for businesses with fewer than 50 full-time employees. It allows employers to reimburse their team for individual health insurance premiums and qualified medical expenses on a tax-free basis.

A QSEHRA offers:

Annual contribution limits: Employers must stay within IRS-set reimbursement caps.

Uniform reimbursements: All employees receive the same reimbursement amount, regardless of role or classification.

Simplified administration: Employers can easily manage reimbursements through a streamlined process, avoiding the complexities of traditional group insurance plans.

Tax advantages: Contributions are tax-free for both employers and employees, reducing overall healthcare costs.

It’s important to note that QSEHRA is only available to small businesses, so larger companies must explore other health benefit options that offer more flexibility.

Key differences between ICHRA and QSEHRA

| Feature | ICHRA | QSEHRA |

|---|---|---|

Eligibility | Available to businesses of any size | Available to businesses with fewer than 50 full-time employees |

Contribution limits | No set contribution limits; can vary based on employee class | Contribution limits: $5,850 for individual and $11,800 for family coverage (2025) |

Employee classes | Employers can create different reimbursement levels for different employee classes (e.g., full-time, part-time) | No employee classes; reimbursement must be the same for all employees |

Group insurance compatibility | Can be used alongside group insurance, but not required | Must be used in place of a group health plan; not compatible with group insurance |

Reimbursement requirements | Reimburses individual health insurance premiums and other qualified medical expenses | Reimburses individual health insurance premiums and other qualified medical expenses |

Tax benefits | Employer contributions are tax-deductible; employee reimbursements are tax-free | Employer contributions are tax-deductible; employee reimbursements are tax-free |

Let's explore the key differences between the two more closely. Understanding these differences will help you make an informed decision about which option best suits your business's size, needs, and goals.

Eligibility

One of the most significant differences between an ICHRA and a QSEHRA is eligibility. An ICHRA is available to businesses of any size, from small startups to large enterprises. This makes it an ideal choice for employers who may want to offer a flexible benefits plan without the restrictions of traditional group insurance.

On the other hand, a QSEHRA is only available to small businesses with fewer than 50 full-time employees, which limits its accessibility for larger companies. This makes an ICHRA a better choice for businesses that may anticipate growth or already employ a larger number of workers.

Contribution limits

Another key difference is the contribution limits. An ICHRA offers more flexibility, as there are no set contribution limits. Employers can decide how much they want to contribute based on employee classes. For example, full-time employees may receive a higher reimbursement than part-time workers, depending on the employer's plan design.

Conversely, a QSEHRA has strict contribution limits. As of 2025, the maximum contribution is $5,850 per year for individual coverage and $11,800 for family coverage.

This fixed limit might be advantageous for small businesses looking for simplicity and predictability, but it can be restrictive for businesses with higher health benefits costs or those with employees requiring more coverage.

Employee classes

An ICHRA offers a significant advantage in its ability to segment employees into different classes, such as full-time or part-time, or employees in different locations or job roles.

This allows for greater flexibility in how benefits are distributed. Employers can tailor the reimbursement amounts based on the unique needs of each group.

A QSEHRA, on the other hand, does not allow for such differentiation. Employers must offer the same reimbursement amount to all employees, which may not be ideal for businesses with a diverse workforce.

Group insurance compatibility

While an ICHRA can be used alongside group health insurance plans, it's not required. This gives employers the option to offer both group insurance and individual coverage through an ICHRA, which may be especially useful for businesses with a mix of employees who need different types of coverage.

In contrast, a QSEHRA cannot be used alongside a group health insurance plan. If an employer opts to offer a QSEHRA, they must forgo offering a group plan to their employees, which could limit their options.

Reimbursement requirements

Both an ICHRA and a QSEHRA allow for reimbursements of individual health insurance premiums and other qualified medical expenses, such as copayments and deductibles. This makes both HRAs valuable tools for helping employees manage their healthcare costs.

However, since both HRAs are structured to offer similar reimbursements, the primary differences lie in the plan design, eligibility, and contribution flexibility.

Tax benefits

ICHRAs and QSEHRAs offer the same tax benefits. Employer contributions to either plan are tax-deductible, while employee reimbursements are tax-free.

This makes both options beneficial for businesses looking to reduce their tax burden while providing valuable health benefits to their employees. The tax advantages are one of the reasons why both HRAs have grown in popularity among employers.

Which HRA is right for your business? Key factors to consider

When deciding between an ICHRA and a QSEHRA, it's important to consider the size and structure of your business, as well as your employees' needs. Let’s break down the benefits of each to help guide you in the right direction.

The benefits of choosing ICHRA

An ICHRA offers a high level of flexibility that can accommodate the unique needs of larger businesses or those experiencing growth. It provides more customization options, which makes it a great choice for companies looking to offer tailored benefits to their employees.

Choose an ICHRA if:

Your business is growing or has over 50 employees.

You want to offer different reimbursement amounts for different employee groups.

You want no reimbursement limits.

You want to offer group health insurance to some employees while others use an ICHRA.

The benefits of choosing QESHRA

A QSEHRA provides simplicity and ease of implementation, making it an attractive option for small businesses with straightforward needs. With fixed contribution limits, it helps smaller companies manage costs effectively while offering tax-free reimbursements.

Choose a QSEHRA if:

Your business has fewer than 50 employees.

You want a simple, tax-free reimbursement structure.

You’re comfortable with a cap on annual contributions.

How to set up an HRA for your business

Setting up an HRA for your business is straightforward when you know the right steps to follow. By choosing the right type of HRA and leveraging an efficient administration platform like Thatch, you can ensure your employees receive the health benefits they need while managing your costs effectively.

Here's a step-by-step guide to setting up an HRA for your business.

Step 1. Determine which HRA type fits your business

Deciding which type of plan best suits your business needs is your first priority. As we've discussed, an ICHRA is ideal for businesses of any size, especially larger companies or those with varied employee needs.

On the other hand, a QSEHRA is a great choice for businesses with fewer than 50 employees, especially if you want a simpler, more predictable reimbursement structure.

Think about your company’s size, employee demographics, and the level of flexibility you need when making this decision.

Step 2. Choose an administration platform (like Thatch)

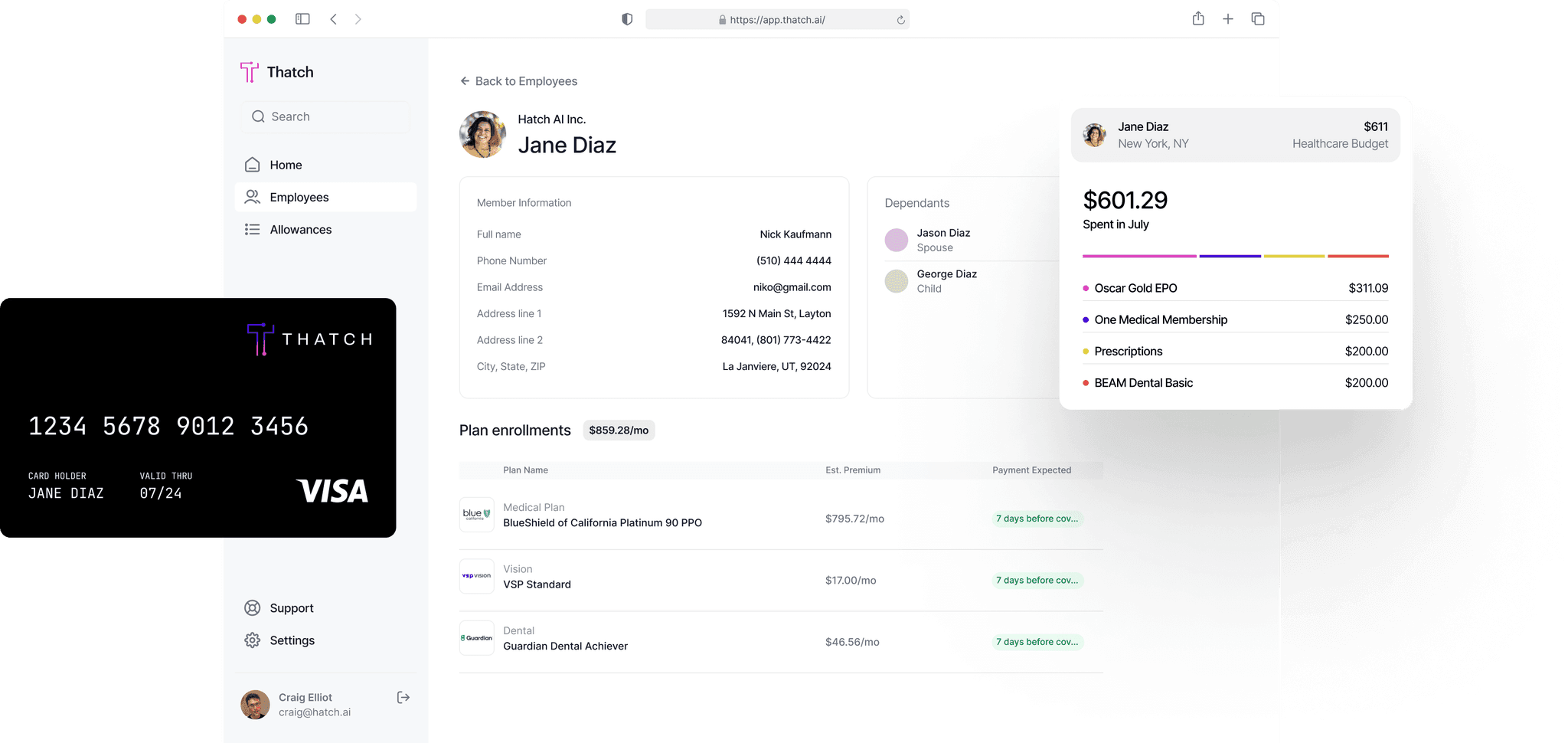

Once you’ve decided on the HRA type, you’ll need to choose an administration platform to manage the plan. A good platform can streamline the process, ensuring contributions, reimbursements, and compliance are handled smoothly.

Thatch is a top choice for businesses looking to set up and manage an HRA, offering a simple, user-friendly platform that helps you administer both ICHRA and QSEHRA plans with ease. Thatch's platform also integrates with other HR tools, allowing you to manage health benefits seamlessly.

Step 3. Define reimbursement amounts and policies

After selecting your HRA type and platform, the next step is to define your reimbursement amounts and policies, which a Thatch administrator can help you do.

With an ICHRA, you'll have the flexibility to establish different reimbursement levels based on employee classes. With a QSEHRA, the amount is capped by law.

It’s important to consider your budget and employee needs when determining reimbursement amounts. If you're using an ICHRA, your ICHRA administrator can help you clearly define which employee groups will receive different amounts and ensure your reimbursement policies comply with legal requirements.

Step 4. Communicate the plan to employees and ensure compliance

Clear communication is key to ensuring your employees understand and can take full advantage of the new benefit. Work with your platform administrator to be transparent about how the HRA works, how employees can submit claims for reimbursement, and any important deadlines.

A Thatch administrator can also ensure your plan complies with federal and state regulations, particularly when it comes to offering tax-free reimbursements.

By following these steps, you can set up an HRA that benefits both your business and your employees. Thatch is here to support you throughout the process, offering the tools and expertise needed to manage your health benefits effectively.

ICHRA vs. QSEHRA FAQs

No, an employer cannot offer both a QSEHRA and an ICHRA to the same group of employees. However, an employer can offer one of these HRAs to certain employee classes while providing other benefits, such as group health insurance, to different employee groups, depending on their eligibility and the company’s structure.

Let's chat about what's the best solution for your business

We are here to help you offer the healthcare experience your employees deserve.