What’s Individual Coverage HRA (ICHRA)?

An Individual Coverage Health Reimbursement Arrangement or ICHRA is a customizable, flexible, and personalized health benefit option that allows employers to reimburse employees for their health insurance premiums and medical expenses.

What’s Individual Coverage HRA (ICHRA)?

An Individual Coverage Health Reimbursement Arrangement or ICHRA is a customizable, flexible, and personalized health benefit option that allows employers to reimburse employees for their health insurance premiums and medical expenses.

ICHRA Plans

ICHRAs are attractive because they provide your business with more flexible and cost-effective healthcare benefits plans for your team. ICHRAs are available to companies of any size, whether they employ part-time or full-time employees.

ICHRA Plans

ICHRAs are attractive because they provide your business with more flexible and cost-effective healthcare benefits plans for your team. ICHRAs are available to companies of any size, whether they employ part-time or full-time employees.

ICHRA Classes

ICHRA classes let businesses organize and manage their health benefits budget by categorizing employees into distinct groups based on hours worked or their geographical location. This segmentation allows for a tailored approach to offering health benefits, enabling employers to offer different types of health plans to different classes of employees.

ICHRA Classes

ICHRA classes let businesses organize and manage their health benefits budget by categorizing employees into distinct groups based on hours worked or their geographical location. This segmentation allows for a tailored approach to offering health benefits, enabling employers to offer different types of health plans to different classes of employees.

Benefits of Individual Coverage HRA

ICHRA allows companies to provide healthcare for their teams in a more personal, flexible, and affordable way.

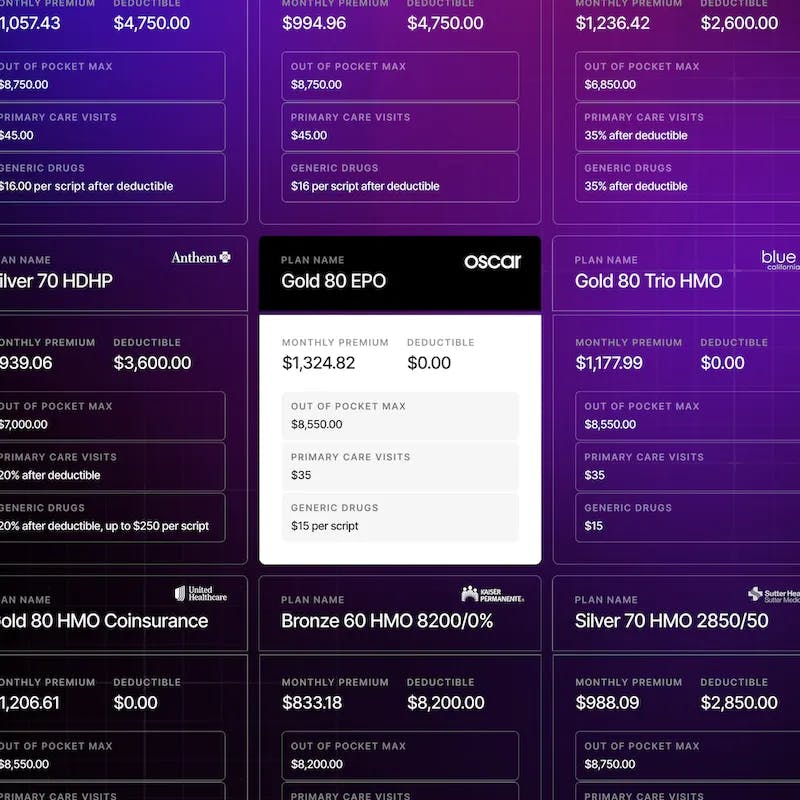

Personalized Health Coverage

Instead of choosing a one-size-fits-all experience, an ICHRA allows you to offer your team a monthly allowance to spend on healthcare the way they want, from health, dental, and vision insurance to out-of-pocket costs like prescriptions or medical bills.

Flexibility in Benefits Design

ICHRAs allow employers to design their health benefits offerings to meet the diverse needs of their employees. Employers can vary allowances based on employees' family status, age, geographic location, and other factors, ensuring equitable access to healthcare benefits.

Cost Control

Employers can set predefined allowances for their employees, helping to control the company's healthcare spending. This model provides financial predictability and can be a cost-effective alternative to traditional health insurance plans.

Simplified Administration

Platforms like Thatch streamline the administration of ICHRAs, making it easier for employers to set up and manage their health benefits programs. This reduces the administrative burden and complexity often associated with offering health insurance.

Tax Advantages

Both employers and employees benefit from tax savings with ICHRAs. Employers can deduct reimbursements as a business expense, while employees can pay for their health insurance premiums with pre-tax dollars, potentially lowering their overall tax burden.

Increased Employee Satisfaction

By allowing employees to choose their own health plans, ICHRAs can lead to higher employee satisfaction and retention. Employees love the ability to select insurance that offers the coverage they need without being limited to the options selected by their employer.

Benefits of Individual Coverage HRA

ICHRA allows companies to provide healthcare for their teams in a more personal, flexible, and affordable way.

Personalized Health Coverage

Instead of choosing a one-size-fits-all experience, an ICHRA allows you to offer your team a monthly allowance to spend on healthcare the way they want, from health, dental, and vision insurance to out-of-pocket costs like prescriptions or medical bills.

Flexibility in Benefits Design

ICHRAs allow employers to design their health benefits offerings to meet the diverse needs of their employees. Employers can vary allowances based on employees' family status, age, geographic location, and other factors, ensuring equitable access to healthcare benefits.

Cost Control

Employers can set predefined allowances for their employees, helping to control the company's healthcare spending. This model provides financial predictability and can be a cost-effective alternative to traditional health insurance plans.

Simplified Administration

Platforms like Thatch streamline the administration of ICHRAs, making it easier for employers to set up and manage their health benefits programs. This reduces the administrative burden and complexity often associated with offering health insurance.

Tax Advantages

Both employers and employees benefit from tax savings with ICHRAs. Employers can deduct reimbursements as a business expense, while employees can pay for their health insurance premiums with pre-tax dollars, potentially lowering their overall tax burden.

Increased Employee Satisfaction

By allowing employees to choose their own health plans, ICHRAs can lead to higher employee satisfaction and retention. Employees love the ability to select insurance that offers the coverage they need without being limited to the options selected by their employer.

How ICHRA works with Thatch

ICHRAs are a super powerful way to give your team healthcare, but come with significant complexity and compliance requirements. Thatch manages all of the complexity associated with administering an ICHRA; we handle budgeting, insurance plan selection, money movement, compliance, reporting, and more. Thatch is the easiest way to provide an ICHRA for your team.

Save money while providing better benefits

Most employers using Thatch save money using an ICHRA instead of a group health plan. The ICHRA allows you to set a fine-grained allowance for every employee, ensuring you're not overpaying for health plans in some markets and underpaying in others.

Monthly healthcare budget

$545

For individuals

$845

For individuals + spouse

$1145

For families

Save money while providing better benefits

Most employers using Thatch save money using an ICHRA instead of a group health plan. The ICHRA allows you to set a fine-grained allowance for every employee, ensuring you're not overpaying for health plans in some markets and underpaying in others.

Monthly healthcare budget

$545

For individuals

$845

For individuals + spouse

$1145

For families

Frequently asked questions about ICHRA

Frequently asked questions about ICHRA

Create the healthcare experience your employees deserve

Thatch works for companies of all sizes and takes minutes to set up.

Create the healthcare experience your employees deserve

Thatch works for companies of all sizes and takes minutes to set up.